Well Paid Musician

Blog

2024 Tax Tip for Self-Employed Musicians

“The ARP required third party settlement organizations (TPSOs), which include popular payment apps and online marketplaces, to report payments of more than $600 for the sale of goods and services on a Form 1099-K starting in 2022.” - www.irs.gov/newsroom

2024 Tax Tip for Self-Employed Performers:

2024 Tax Tip: This year (2024), pay all your contractors via one electronic pay method like PayPal or Venmo so that you can reduce or eliminate issuing 1099s next year. This is because of the new 1099-K.

Form 1099-K was introduced with the American Rescue Plan. The ARP required third party settlement organizations (TPSOs) e.g. PayPal/Venmo, to report payments of more than $600 for the sale of goods and services on a Form 1099-K starting in 2022.

The $600 threshold has been postponed. For the 2023 tax year, the threshold is $20,000 or 200 transactions. So unless you’ve paid each individual contractor 200 times or $20K +, then you're going to have to issue 1099-NECs for 2023.

Here’s how you do it.

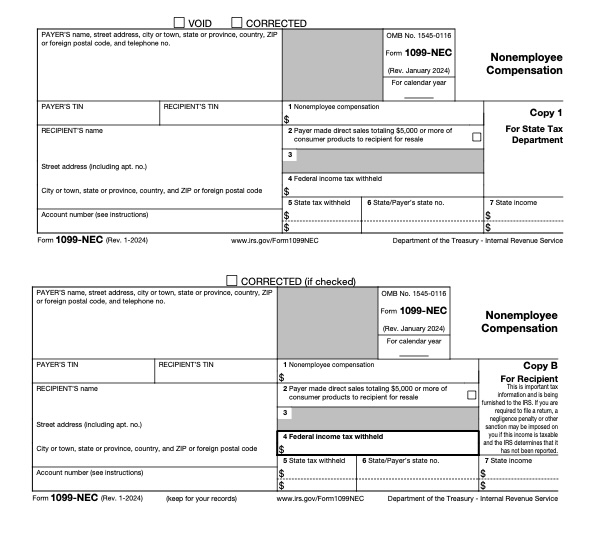

Any contractor you pay $600 or more in a calendar year has to be reported to the IRS on Form 1099-NEC. This could be anyone from a musician you hire in a gig, a sound tech, a producer, a videographer, any non-employee, you pay at least $600 for services in a year.

This is what the 1099-NEC form looks like 👇

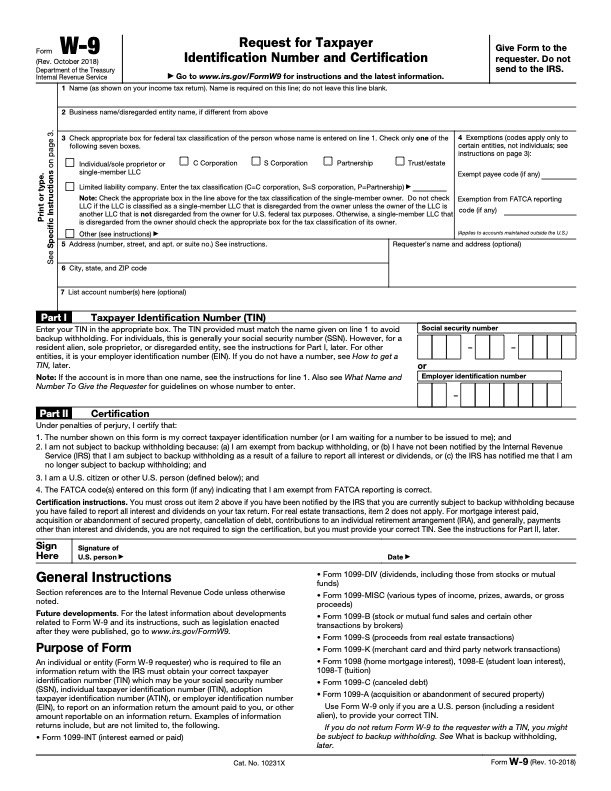

Step 1: Ask the contractor for a W-9. It looks like this 👇

Have the contractor fill it out and send it back to you.

Pro Tip: Get the contractor to send you their W-9 before you pay them. Otherwise, you will have to chase them down at tax time, and may get ghosted 👻

Step 2: Go to a site like track1099.com and submit the information from the W-9.

This issues the 1099s to your contractors, and the IRS will receive that information as well.

It's best to do this in January. It's currently the beginning of February, so you're not too late. Just get it done ASAP.

Watch the quick tutorial on YouTube 👇

Ready to scale your music business to six figures?

Want to Be A Part Of Our Success Story?

Hear what WPM students are saying about the program